CO2 Removal Certificates – The Missing Link Between Investors and Carbon Sinks

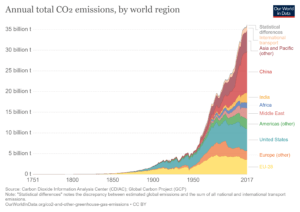

Despite wide international consensus, triumph of renewable energy generation technologies and carbon footprinting becoming into mainstream, the world greenhouse gas emissions continue to raise. Some leading experts have already for a long time been saying that just reducing emissions is not enough, but that we actually have to actively remove CO2 from the atmosphere.

There is a myriad of choice and variety of trustworthiness available in CO2 reduction and allowance markets. However, for socially responsible corporations, individuals and impact investors who actually want remove existing CO2, the choices have so far been limited.

Puro CO2 removal certificates (CORC) turn carbon sequestration capability of the CO2 net-negative products into digital tradable assets. For example a producer of biochar or wooden building elements can get extra revenue and partly finance their investments by selling the resulting CORCs. For investors other buyers there is now a novel and liquid instrument with verified negative CO2 emissions.

Yes, there is a market! Puro is more than yet another “plant-a-tree” certification program. Besides strict scheme rules including third party verification and conservative calculation methods, there is an organized market for CORCs operational since May 2019. The market takes place in the form of regular auctions including delivery versus payment (DVP) service.

Puro uses Grexel’s technology and service concepts. CORCs are issued and transferred in Grexel’s registry service, which is off-the-shelf platform modified to cater for CORCs. The market is organized using Grexel auctioning service. “Grexel’s already existing technologies, service concept and expertise enabled us to go to production fast and at the same time limiting risks and investment into IT.”, says Marianne Tikkanen, Innovation Manager at Fortum and co-founder of Puro.

Also Grexel used CORCs to compensate for 2018 induced CO2 emissiong. See news item and full report here.

Grexel is the leading energy certificate registry provider in Europe headquartered in Helsinki with an annual transaction volume of over one billion MWhs. The registries are used by over ten thousand active account holders in 15 countries. As part of EEX Group, Grexel also helps its customers to design new certification schemes and cope with changing requirements set by international legislation and standards.

EEX Group is a group of specialised companies providing market platforms for energy and commodity products across the globe. The offering of the group comprises trading in energy, environmentals, freight, metals and agriculturals as well as subsequent clearing and registry services. EEX Group is based in 17 worldwide locations and is part of Deutsche Börse Group.